Chainlink (LINK) Analysis: Navigating the Market Dynamics and Future Prospects

Chainlink (LINK) Analysis: Navigating the Market Dynamics and Future Prospects - Analysis analysis and insights

Chainlink (LINK) currently trades at $17.53, reflecting a 4.06% daily increase. With a market cap of $12.21 billion, LINK is poised for growth due to its pivotal role in DeFi. Key price levels to watch are the $16.50 support and $20.00 resistance.

Chainlink Market Overview

As of October 19, 2025, Chainlink (LINK) is trading at $17.53. It's seen a 4.06% increase in the past 24 hours, suggesting a strong short-term momentum. With a market cap of $12.21 billion, Chainlink holds the #16 position in the crypto market, underscoring its significant presence and impact.

Key Metrics

- Current Price: $17.53 - 24-hour Price Change: +4.06% - Market Cap: $12.21 billion - Trading Volume: $0.65 billionLINK Technical Analysis

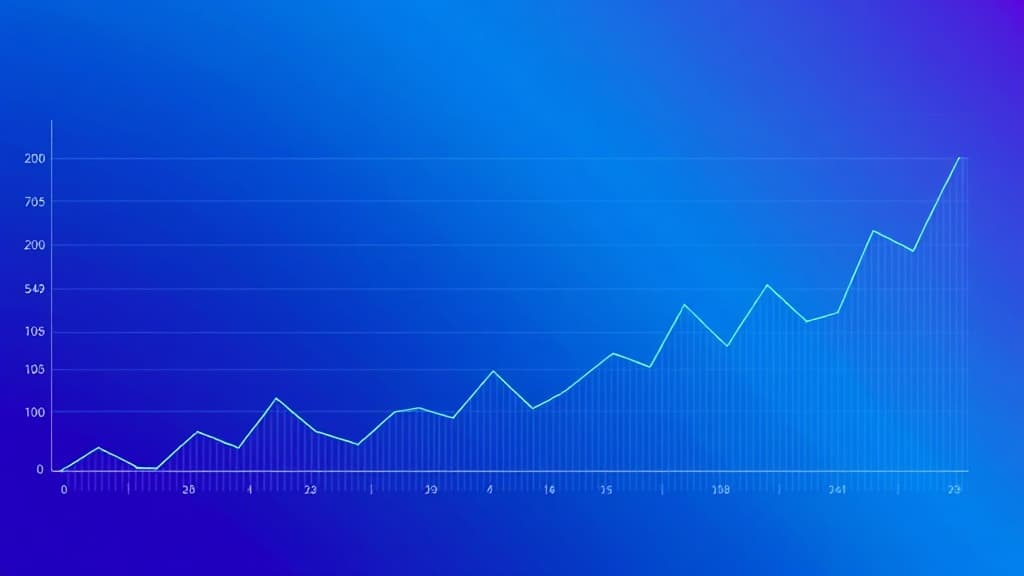

Let's dive into what the charts are showing us. Chainlink has made an impressive recovery from its all-time high (ATH) of $52.70 on May 10, 2021. Despite being down 66.78% from its ATH, the recent uptick hints at a potential bullish trend.

Chart Patterns and Indicators

- Support Level: Around $16.50 - Resistance Level: Near $20.00 - Volume-to-Market Cap Ratio: 5.36%The resistance at $20.00 is a psychological barrier—a break above could pave the way for testing higher levels. The Relative Strength Index (RSI) suggests LINK might still have room to grow, as it's not in overbought territory yet.

Chainlink Fundamentals

Chainlink is a linchpin in the DeFi landscape, providing decentralized oracle solutions that ensure data accuracy in smart contracts. Recent partnerships and technological enhancements bolster its infrastructure, making it a go-to for reliability and security in blockchain applications.

Recent Developments

- Partnerships with major financial institutions - Technological upgrades enhancing network efficiencyThese advancements reinforce Chainlink's position as a critical player in the blockchain ecosystem.

LINK On-Chain Analysis

While specific on-chain metrics aren't detailed here, Chainlink's network health is generally evaluated through active nodes, transaction volume, and new data feed integrations. A robust network activity indicates growing utility and adoption.

Chainlink Scenarios and Price Targets

What could the future hold for LINK? Let's consider a few scenarios:

1. Bullish Scenario: Continued adoption of smart contracts and DeFi applications could push LINK to break the $20.00 resistance, potentially testing the $25.00 range if market conditions remain favorable.

2. Bearish Scenario: If the broader market faces a downturn, LINK might retrace to its support level at $16.50 or lower.

3. Neutral Scenario: Consolidation between $16.50 and $20.00, allowing for accumulation phases.

LINK Trading Strategy and Risk Management

Traders should consider swing trading around key support and resistance levels, leveraging the current volatility. Long-term investors might look to accumulate LINK during dips, given its strategic importance.

Risk Management Tips

- Set stop-loss orders to mitigate potential losses - Diversify your portfolio to manage risk effectivelyFinal Verdict and Key Chainlink Takeaways

Chainlink remains a fundamental component of the decentralized finance landscape, with significant growth potential. Its robust market position and ongoing technological developments suggest a promising future.

- Focus on the $20.00 resistance and $16.50 support - Watch for broader market trends impacting LINK - Consider long-term accumulation strategies

In conclusion, Chainlink's current market dynamics and strategic advancements position it well for future growth, making it a crucial asset in any diversified crypto portfolio.

Educational Content Only — Not Financial Advice

This article provides educational information only and does not constitute financial, investment, trading, or legal advice. Cryptocurrency investments carry significant risk, including the potential loss of principal. Always conduct your own research and consult with licensed financial professionals before making investment decisions. Past performance does not guarantee future results. CryptoLumos and its authors assume no liability for financial decisions made based on this content.

Related Articles

Continue exploring more insights

Navigating the Cosmos (ATOM) Market: Key Insights and Strategic Analysis

Cosmos (ATOM) sits at $3.14 with a market cap of $1.49 billion. Despite a 4.62% dip, its strong fundamentals and ongoing developments present growth potential. Key levels are $3.00 support and $3.50 resistance.

Navigating Stellar (XLM) in 2025: Expert-Level Analysis and Price Insights

Stellar (XLM) is priced at $0.310338, with key support at $0.300 and resistance at $0.350. Watch for protocol upgrades and partnerships as potential catalysts.

In-Depth Filecoin (FIL) Analysis: Navigating the Current Market Landscape

Filecoin (FIL) trades at $1.63 with a 2.92% 24-hour change, sitting at #104 by market cap. With strong support at $0.848 and resistance at $2.00, FIL navigates a volatile market, offering potential but necessitating caution.

Image Gallery

Comments

Share your thoughts and join the discussion

Leave a Comment

No comments yet

Be the first to share your thoughts!