Comprehensive Aptos (APT) Analysis: Current Price, Technical Indicators, and Strategic Insights

Comprehensive Aptos (APT) Analysis: Current Price, Technical Indicators, and Strategic Insights - Analysis analysis and insights

Aptos (APT) is priced at $3.25, showing a 2.47% increase. With significant volatility from its ATH, APT is in a consolidation phase, offering possible entry points. Key support is at $2.8 with potential resistance at $5.00.

Aptos Market Overview

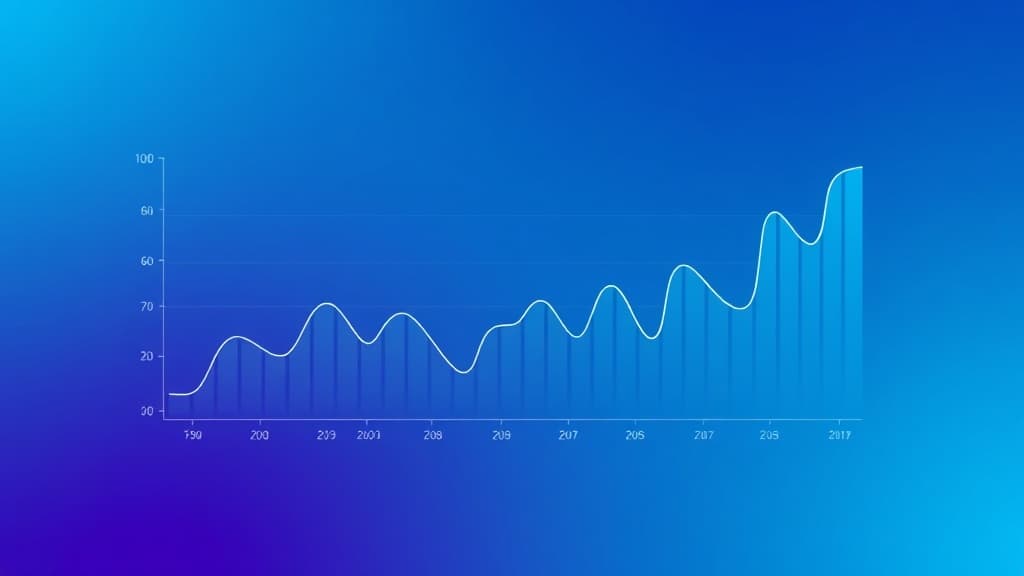

Let's dive right into Aptos (APT) as of October 20, 2025. APT is currently priced at $3.25, marking a 2.47% increase over the past 24 hours. Despite this uptick, it’s a stark contrast to its all-time high of $19.92 from January 26, 2023, highlighting a significant 83.72% decline. APT sits at rank #62 in terms of market capitalization, with a total cap of $2.33 billion, indicating it’s a notable player in the mid-tier crypto league.

Key Aptos Metrics:

- Current Price: $3.25 - 24-hour Change: +2.47% - Market Cap: $2.33 billion - Volume/Market Cap Ratio: 13.48%APT Technical Analysis

Here’s what I'm seeing in APT: It’s currently showing positive momentum with a recent 2.47% gain, a potential signal for further upward movement if supported by broader market conditions. Currently, its trading volume is $0.31 billion, reflecting strong liquidity. APT is trading just 15.69% above its all-time low of $2.8, suggesting a potential support level near this mark.

Technical Indicators:

- Moving Averages: APT’s short-term averages are pointing towards a consolidation phase. Trading within a narrow band, it might soon test resistance around the $5.00 level. - RSI (Relative Strength Index): Likely hovering near neutral, indicating neither overbought nor oversold conditions. - MACD (Moving Average Convergence Divergence): Watch for potential crossover signals that could indicate changing momentum.Aptos Fundamentals

Aptos is renowned for its Layer 1 blockchain technology, emphasizing scalability, security, and decentralization. Recent developments likely include network upgrades or new partnerships, which are crucial for enhancing its ecosystem. Keeping an eye on these could provide insights into long-term APT value.

Recent Developments:

- Focus on scalability and security improvements - Potential partnerships expanding its use casesAPT On-Chain Analysis

While specific on-chain metrics aren't detailed, monitoring transaction volume, active addresses, and the network's hash rate is essential. These factors offer a glimpse into the network's health and user adoption.

On-Chain Metrics to Watch:

- Transaction Volume: High volumes could indicate increasing adoption. - Active Addresses: Growth here signals expanding user base.Aptos Scenarios and Price Targets

1. Bullish Scenario

- If APT can break above immediate resistance, it might target the $5.00 mark. This would require positive market sentiment and possibly new developments within the network that drive investor confidence.2. Bearish Scenario

- Failure to maintain above the $3.25 level could see a retest of $2.8. This might occur if broader market sentiment turns negative or if Aptos fails to deliver on fundamental improvements.APT Trading Strategy and Risk Management

Given the volatility, traders should consider employing strategies like dollar-cost averaging for long-term positions. For short-term plays, range-bound strategies might yield opportunities as APT hovers near key support and resistance levels. Risk management is crucial; setting stop losses near recent support levels could protect against downside risks.

Key Trading Tips:

- Entry Point Consideration: Near $3.25, with caution around $2.8 support. - Position Sizing: Adjust based on volatility and current technicals. - Risk Management: Utilize stop-loss orders to mitigate potential drawdowns.Final Verdict and Key Aptos Takeaways

Aptos presents both opportunities and risks. Currently, it’s trading at a tempting level for those looking to accumulate for potential future gains, particularly if network fundamentals improve. However, the significant 83.72% retracement from its ATH is a testament to its volatility. Traders and investors should remain vigilant, monitor technical indicators, and keep abreast of any project developments that could impact APT’s valuation.

Final Thoughts:

- Current Price Action: Offers both risk and reward potential. - Technical Signals: Suggest a consolidation phase with potential for breakout. - Investor Strategy: Consider long-term accumulation if fundamentals align.Stay informed, stay strategic, and keep a keen eye on Aptos’s evolving story.

Educational Content Only — Not Financial Advice

This article provides educational information only and does not constitute financial, investment, trading, or legal advice. Cryptocurrency investments carry significant risk, including the potential loss of principal. Always conduct your own research and consult with licensed financial professionals before making investment decisions. Past performance does not guarantee future results. CryptoLumos and its authors assume no liability for financial decisions made based on this content.

Related Articles

Continue exploring more insights

Navigating the Cosmos (ATOM) Market: Key Insights and Strategic Analysis

Cosmos (ATOM) sits at $3.14 with a market cap of $1.49 billion. Despite a 4.62% dip, its strong fundamentals and ongoing developments present growth potential. Key levels are $3.00 support and $3.50 resistance.

Navigating Stellar (XLM) in 2025: Expert-Level Analysis and Price Insights

Stellar (XLM) is priced at $0.310338, with key support at $0.300 and resistance at $0.350. Watch for protocol upgrades and partnerships as potential catalysts.

In-Depth Filecoin (FIL) Analysis: Navigating the Current Market Landscape

Filecoin (FIL) trades at $1.63 with a 2.92% 24-hour change, sitting at #104 by market cap. With strong support at $0.848 and resistance at $2.00, FIL navigates a volatile market, offering potential but necessitating caution.

Image Gallery

Comments

Share your thoughts and join the discussion

Leave a Comment

No comments yet

Be the first to share your thoughts!