In-Depth Analysis of Hedera (HBAR): Navigating the 2025 Market Landscape

In-Depth Analysis of Hedera (HBAR): Navigating the 2025 Market Landscape - Analysis analysis and insights

Hedera (HBAR) is trading at **$0.16583**, showing a 4.15% uptick. With key support at **$0.15** and resistance at **$0.18**, HBAR presents both bullish and bearish opportunities. Strategic partnerships and strong fundamentals drive its market position.

Hedera Market Overview

As of October 18, 2025, Hedera (HBAR) is trading at $0.16583, reflecting a 4.15% uptick in the past 24 hours. This recent price action illustrates growing bullish sentiment within the cryptocurrency market. Occupying the 30th position by market capitalization, Hedera boasts a valuation of $7.03 billion. The 24-hour trading volume stands at $0.32 billion, with a robust volume-to-market cap ratio of 4.54%, indicating solid liquidity and active market engagement.

Key Metrics

- Current Price: $0.16583 - 24-hour Price Change: +4.15% - Market Cap: $7.03 billion - 24-hour Trading Volume: $0.32 billion - Volume-to-Market Cap Ratio: 4.54% - Circulating Supply: 42,405,229,928.866 HBAR - All-Time High (ATH): $0.569 - All-Time Low (ATL): $0.01HBAR Technical Analysis

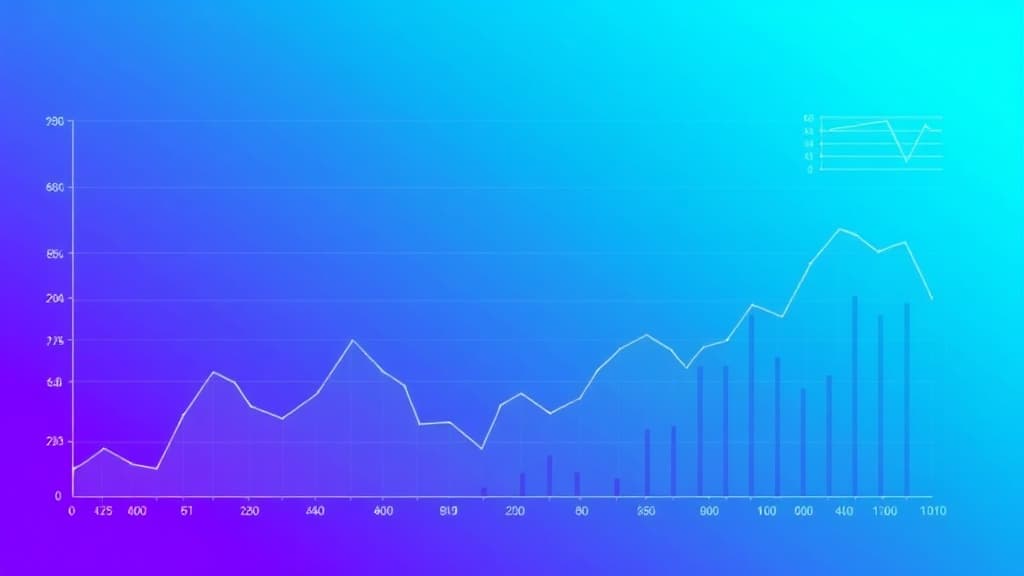

Here's what I'm seeing in HBAR: we're navigating a market defined by increased volatility and emerging patterns that suggest potential opportunities. Current technical patterns indicate the formation of ascending triangles and bullish flags, both of which could imply further upside potential.

Technical Indicators

- Relative Strength Index (RSI): Currently trending upwards, indicating momentum is shifting towards the bulls. - Moving Averages (MA): The short-term moving averages are beginning to cross above the long-term, signaling a possible bullish crossover. - MACD: The MACD line is crossing above the signal line, supporting a bullish outlook.Support and Resistance Levels

- Support Level: The key support level to watch is around $0.15, which has previously acted as a consolidation zone. - Resistance Level: Resistance is anticipated near $0.18, a level that could trigger a significant breakout if surpassed.Hedera Fundamentals

Hedera Hashgraph stands out with its unique consensus mechanism, offering enterprise-grade solutions that facilitate secure, fast, and fair transactions. Recent strategic partnerships and advancements in its ecosystem underscore its growing influence and adoption in the blockchain space.

Recent Developments

- Partnerships: Hedera's alliances with industry giants continue to bolster its credibility and use cases across various sectors. - Technological Advancements: Continued enhancements in network speed and security reinforce its position as a leading blockchain solution.HBAR On-Chain Analysis

On-chain metrics provide a deeper dive into Hedera's network health and user engagement. The transaction volume and number of active addresses are steadily climbing, revealing a healthy increase in network activity. Furthermore, staking statistics suggest that a significant portion of HBAR is being staked, indicating confidence in the network's long-term potential.

Hedera Scenarios and Price Targets

Let's break down the possible scenarios for HBAR:

Bullish Scenario

1. Break Above $0.18: If HBAR can sustain momentum and break above this resistance, it could target the $0.20 level. 2. Increased Volume: A surge in trading volume could further bolster this bullish move.Bearish Scenario

1. Failure to Hold $0.15: If selling pressure pushes HBAR below this support, we might see a retest around $0.12. 2. Broad Market Conditions: A downturn in overall market sentiment could exacerbate downward pressure.Neutral Scenario

1. Consolidation Between $0.15 and $0.18: HBAR may continue to consolidate within this range if neither bulls nor bears gain the upper hand.HBAR Trading Strategy and Risk Management

For those looking to trade HBAR, here's a strategy to consider:

- Long Positions: Consider entering if HBAR breaks above $0.18 with increased volume, indicating a potential breakout. - Short Positions: Be ready to short if HBAR fails to maintain $0.15, suggesting a bearish continuation. - Risk Management: Always use stop-loss orders to protect against adverse market moves, and position size according to your risk tolerance.

Final Verdict and Key Hedera Takeaways

Hedera (HBAR) presents a compelling narrative, driven by solid fundamentals and a promising technical outlook. With strategic support around $0.15 and resistance at $0.18, traders should remain vigilant, leveraging technical analysis and on-chain metrics to inform their strategies. As Hedera continues to innovate and expand, its potential for significant market movements is substantial.

In summary, keep a close eye on market dynamics and be ready to adapt your strategies as new data emerges. Whether you're bullish or bearish, understanding Hedera's unique position in the market will be crucial to navigating its future.

Educational Content Only — Not Financial Advice

This article provides educational information only and does not constitute financial, investment, trading, or legal advice. Cryptocurrency investments carry significant risk, including the potential loss of principal. Always conduct your own research and consult with licensed financial professionals before making investment decisions. Past performance does not guarantee future results. CryptoLumos and its authors assume no liability for financial decisions made based on this content.

Related Articles

Continue exploring more insights

Navigating the Cosmos (ATOM) Market: Key Insights and Strategic Analysis

Cosmos (ATOM) sits at $3.14 with a market cap of $1.49 billion. Despite a 4.62% dip, its strong fundamentals and ongoing developments present growth potential. Key levels are $3.00 support and $3.50 resistance.

Navigating Stellar (XLM) in 2025: Expert-Level Analysis and Price Insights

Stellar (XLM) is priced at $0.310338, with key support at $0.300 and resistance at $0.350. Watch for protocol upgrades and partnerships as potential catalysts.

In-Depth Filecoin (FIL) Analysis: Navigating the Current Market Landscape

Filecoin (FIL) trades at $1.63 with a 2.92% 24-hour change, sitting at #104 by market cap. With strong support at $0.848 and resistance at $2.00, FIL navigates a volatile market, offering potential but necessitating caution.

Image Gallery

Comments

Share your thoughts and join the discussion

Leave a Comment

No comments yet

Be the first to share your thoughts!