Navigating Crypto and Traditional Markets: An Expert's Perspective on Correlation Dynamics

Navigating Crypto and Traditional Markets: An Expert's Perspective on Correlation Dynamics - Analysis analysis and insights

Explore the intricate relationship between crypto and traditional markets, highlighting key technical indicators and trading strategies. Historical insights offer a roadmap for navigating this volatile landscape.

Market Overview

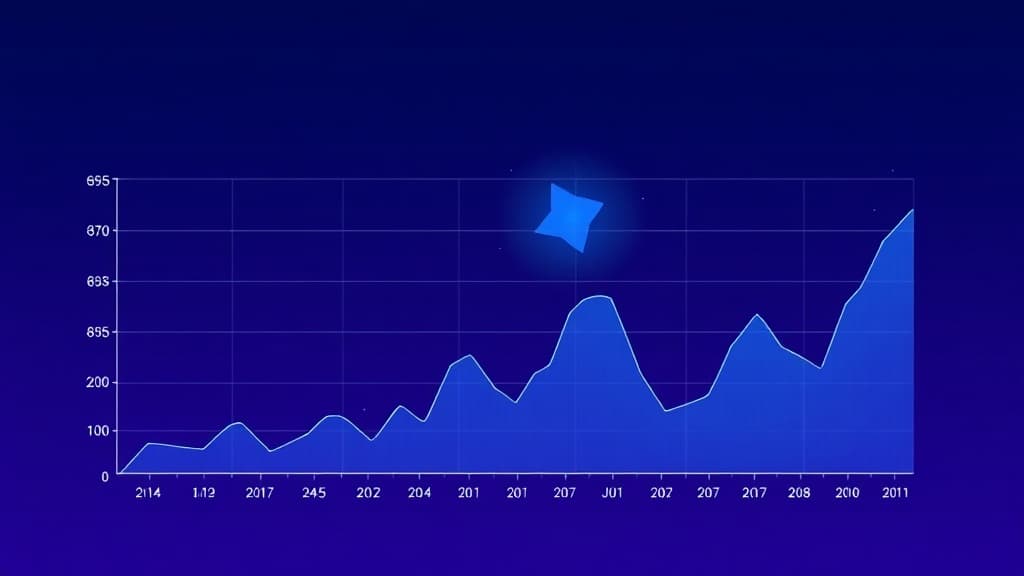

Let's dive right into what's happening in the crypto world. While I can't give you live prices for Bitcoin and Ethereum, there's plenty to discuss about the interplay between cryptocurrencies and traditional markets. Historically, we've seen Bitcoin and Ethereum exhibit notable volatility, often swayed by macroeconomic factors like inflation rates and interest changes. These digital assets have displayed both correlation and decoupling from big indices like the S&P 500 and NASDAQ.

Technical Analysis

Historical Patterns and Indicators:Bitcoin and Ethereum's price movements are often dictated by key technical indicators. Although exact prices aren't available, let's consider the tools traders typically use:

- Moving Averages: Short-term price trends can be identified using the 50-day and 200-day moving averages. When the 50-day crosses above the 200-day, we get a golden cross, often signaling a bullish trend. - Relative Strength Index (RSI): An RSI above 70 suggests overbought conditions, while below 30 indicates oversold. Monitoring these levels can provide insights into potential reversals. - MACD (Moving Average Convergence Divergence): This indicator helps spot changes in momentum. Watch for the MACD line crossing above the signal line.

Support and Resistance Levels:It's important to keep psychological price points in mind. Historically, levels like $10,000 and $20,000 for Bitcoin have acted as significant support or resistance. Use Fibonacci retracements to identify potential reversal levels, especially during volatile periods.

On-Chain Analysis

Key Metrics:- Transaction Volume: A surge often indicates increased interest. Historically, higher volumes precede bullish movements. - Hash Rate: A higher hash rate suggests network security and miner confidence, which can be bullish. - Active Addresses: When this number rises, it's often a sign of growing user engagement, a precursor to increased demand.

Sentiment Analysis

Market sentiment is a powerful driver in crypto. The Fear & Greed Index, while unavailable currently, provides insights into market psychology. High greed levels can signal a market that's due for a correction, while extreme fear often marks undervalued conditions ripe for buying.

Scenarios and Price Targets

Bullish Scenario

1. Bitcoin as Digital Gold: In times of macroeconomic instability, Bitcoin could see increased demand as a safe haven. 2. Ethereum's Ecosystem Growth: With DeFi and NFTs driving network utilization, Ethereum's price could appreciate significantly.

Bearish Scenario

1. Regulatory Pressures: Increased regulatory scrutiny might dampen market enthusiasm and trigger sell-offs. 2. Macroeconomic Stability: If traditional markets stabilize, the allure of cryptocurrencies as alternative investments might diminish.

Trading Strategy and Risk Management

Here's what I'm seeing in terms of strategy:

- Long-term Holding: Given crypto's historical growth, holding Bitcoin and Ethereum could be wise for those with a high-risk tolerance. - Volatility Trading: Leverage derivatives like options to capitalize on price swings without owning the asset. - Correlation Arbitrage: Exploit crypto's correlation with traditional markets to identify inefficiencies.

Risk Management Tips: - Diversify your portfolio to spread risk. - Use stop-loss orders to protect against downside.Final Verdict and Key Takeaways

The crypto market's relationship with traditional markets remains complex and multi-faceted. While we can't provide live data, historical insights suggest a mix of volatility and opportunity. As always, thorough research and solid risk management are crucial. Keep an eye on macroeconomic indicators and sentiment shifts for clues on market direction.

In summary, while price accuracy is out of reach, the dynamics at play suggest a market ripe with both risk and reward.

Educational Content Only — Not Financial Advice

This article provides educational information only and does not constitute financial, investment, trading, or legal advice. Cryptocurrency investments carry significant risk, including the potential loss of principal. Always conduct your own research and consult with licensed financial professionals before making investment decisions. Past performance does not guarantee future results. CryptoLumos and its authors assume no liability for financial decisions made based on this content.

Related Articles

Continue exploring more insights

Navigating the Cosmos (ATOM) Market: Key Insights and Strategic Analysis

Cosmos (ATOM) sits at $3.14 with a market cap of $1.49 billion. Despite a 4.62% dip, its strong fundamentals and ongoing developments present growth potential. Key levels are $3.00 support and $3.50 resistance.

Navigating Stellar (XLM) in 2025: Expert-Level Analysis and Price Insights

Stellar (XLM) is priced at $0.310338, with key support at $0.300 and resistance at $0.350. Watch for protocol upgrades and partnerships as potential catalysts.

In-Depth Filecoin (FIL) Analysis: Navigating the Current Market Landscape

Filecoin (FIL) trades at $1.63 with a 2.92% 24-hour change, sitting at #104 by market cap. With strong support at $0.848 and resistance at $2.00, FIL navigates a volatile market, offering potential but necessitating caution.

Image Gallery

Comments

Share your thoughts and join the discussion

Leave a Comment

No comments yet

Be the first to share your thoughts!