Navigating the Stellar (XLM) Price Landscape: Key Insights and Strategic Opportunities

Navigating the Stellar (XLM) Price Landscape: Key Insights and Strategic Opportunities - Analysis analysis and insights

Stellar (XLM) is trading at $0.293966, with a recent 8.96% decline. Key support at $0.280 and resistance at $0.320 will determine its next move. Explore strategic opportunities in XLM trading now.

Stellar Market Overview

As of October 17, 2025, Stellar (XLM) is trading at $0.293966. Over the past 24 hours, XLM has witnessed a significant downtrend, declining by 8.96%. This drop positions Stellar in a broader market contraction, echoing declines in heavyweights like Bitcoin and Ethereum. Currently ranking #19 by market capitalization, XLM holds a market cap of $9.40 billion, underscoring its prominence yet modest dominance compared to the crypto giants.

Key Stellar Metrics

- Current Price: $0.293966 - 24-hour Decline: 8.96% - Market Cap: $9.40 billion - Trading Volume: $0.36 billion - Rank: #19XLM Technical Analysis

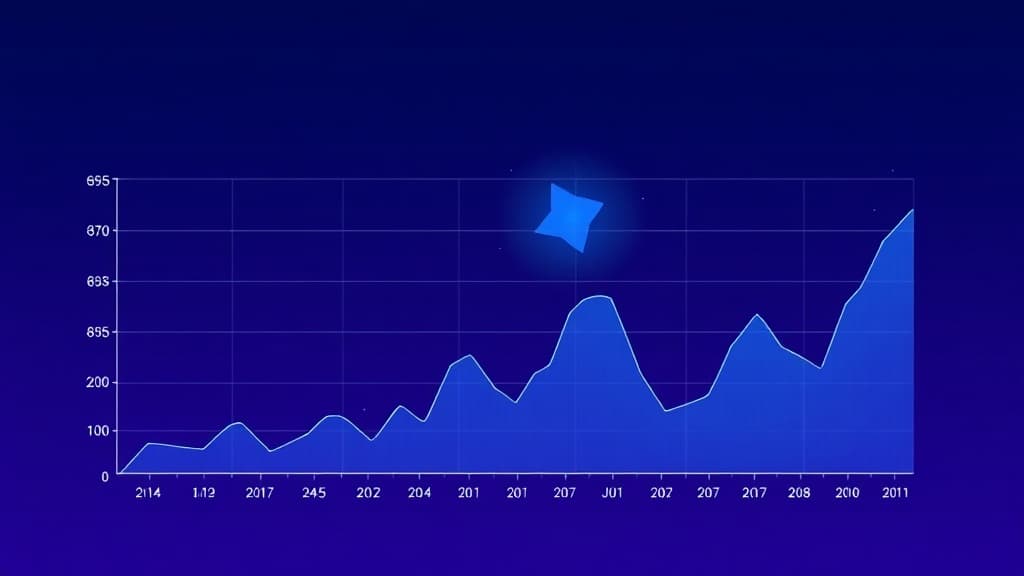

Here's what I'm seeing in XLM: the recent price action suggests a notable downtrend, with technical indicators pointing towards a potential critical support level. The Relative Strength Index (RSI) is hovering in oversold territory, indicating that a reversal could be on the cards if momentum shifts.

Key support is apparent around the $0.280 level, which is crucial for any potential price recovery. Resistance looms near $0.320, a level where traders might encounter selling pressure should XLM attempt a rebound. The Moving Average Convergence Divergence (MACD) indicates bearish momentum, but a crossover could signal a shift.

Chart Patterns to Watch

- Support Level: $0.280 - Resistance Level: $0.320 - RSI: Oversold, possible reversal - MACD: Bearish, potential crossoverStellar Fundamentals

Stellar's focus remains on enhancing cross-border payments and financial inclusion. The network leverages a unique consensus mechanism, positioning itself as a pivotal player in the financial sector. Recent network upgrades and partnerships with financial institutions might bolster its utility, potentially driving demand.

Project Updates and Ecosystem

- Cross-border payments: Continued development - Partnerships: Strengthening financial ties - Network Upgrades: Enhancements to improve scalabilityXLM On-Chain Analysis

Analyzing Stellar's on-chain metrics provides a deeper understanding of its network health. With a circulating supply of 32,000,682,404.439 XLM, against a total supply of 50,001,786,884.696 XLM, the dynamics suggest a significant portion remains locked, influencing potential future movements as these coins enter circulation.

On-Chain Metrics

- Circulating Supply: 32,000,682,404.439 XLM - Total Supply: 50,001,786,884.696 XLMStellar Scenarios and Price Targets

1. Bullish Case

- Support Holds at $0.280: If this level holds, XLM could see a rebound towards $0.320. - Market Recovery: Broader market stabilization could propel XLM beyond resistance levels.2. Bearish Case

- Support Breach: Falling below $0.280 could see XLM retesting lower levels, increasing downside risks. - Continued Market Pressure: Ongoing bearish sentiment might weigh heavily on Stellar's price.3. Neutral Scenario

- Sideways Movement: A lack of momentum might keep XLM fluctuating between support and resistance.XLM Trading Strategy and Risk Management

Traders might consider accumulating XLM at its current price, with stop-loss orders strategically placed below the $0.280 support to mitigate risks. For those seeking to capitalize on potential rebounds, exits near $0.320 could offer attractive risk-reward ratios.

Trading Considerations

- Accumulation Point: Around current price level - Stop-Loss: Below $0.280 - Exit Strategy: Targeting $0.320Final Verdict and Key Stellar Takeaways

The Stellar data suggests that while XLM faces near-term challenges, its foundational strengths and positioning in cross-border payments offer promising long-term prospects. With a strategic approach focusing on current support and resistance levels, traders can navigate Stellar's current landscape effectively.

In summary, Stellar (XLM) remains a project with substantial potential, bolstered by its recent developments and strategic focus. While the current market environment poses challenges, informed strategies could uncover compelling opportunities.

Educational Content Only — Not Financial Advice

This article provides educational information only and does not constitute financial, investment, trading, or legal advice. Cryptocurrency investments carry significant risk, including the potential loss of principal. Always conduct your own research and consult with licensed financial professionals before making investment decisions. Past performance does not guarantee future results. CryptoLumos and its authors assume no liability for financial decisions made based on this content.

Related Articles

Continue exploring more insights

Navigating the Cosmos (ATOM) Market: Key Insights and Strategic Analysis

Cosmos (ATOM) sits at $3.14 with a market cap of $1.49 billion. Despite a 4.62% dip, its strong fundamentals and ongoing developments present growth potential. Key levels are $3.00 support and $3.50 resistance.

Navigating Stellar (XLM) in 2025: Expert-Level Analysis and Price Insights

Stellar (XLM) is priced at $0.310338, with key support at $0.300 and resistance at $0.350. Watch for protocol upgrades and partnerships as potential catalysts.

In-Depth Filecoin (FIL) Analysis: Navigating the Current Market Landscape

Filecoin (FIL) trades at $1.63 with a 2.92% 24-hour change, sitting at #104 by market cap. With strong support at $0.848 and resistance at $2.00, FIL navigates a volatile market, offering potential but necessitating caution.

Image Gallery

Comments

Share your thoughts and join the discussion

Leave a Comment

No comments yet

Be the first to share your thoughts!