Navigating VeChain (VET): An Expert Analysis of Current Market Dynamics

Navigating VeChain (VET): An Expert Analysis of Current Market Dynamics - Analysis analysis and insights

VeChain (VET) is trading at $0.01717391, down by 1.08%. With support at $0.015 and resistance at $0.020, VET faces key technical levels as it navigates its enterprise-focused growth strategy.

VeChain Market Overview

As of October 18, 2025, VeChain (VET) is trading at $0.01717391, reflecting a 24-hour price change of -1.08%. This positions VeChain as a player in the mid-cap cryptocurrency market, with a market capitalization of $1.48 billion, ranking it 84th overall. Despite a challenging period marked by significant price fluctuations, VeChain continues to attract attention due to its robust use cases and strategic focus on supply chain solutions.

Key Metrics

- Current VET price: $0.01717391 - 24-hour price change: -1.08% - Market cap: $1.48 billion - Market rank: #84VET Technical Analysis

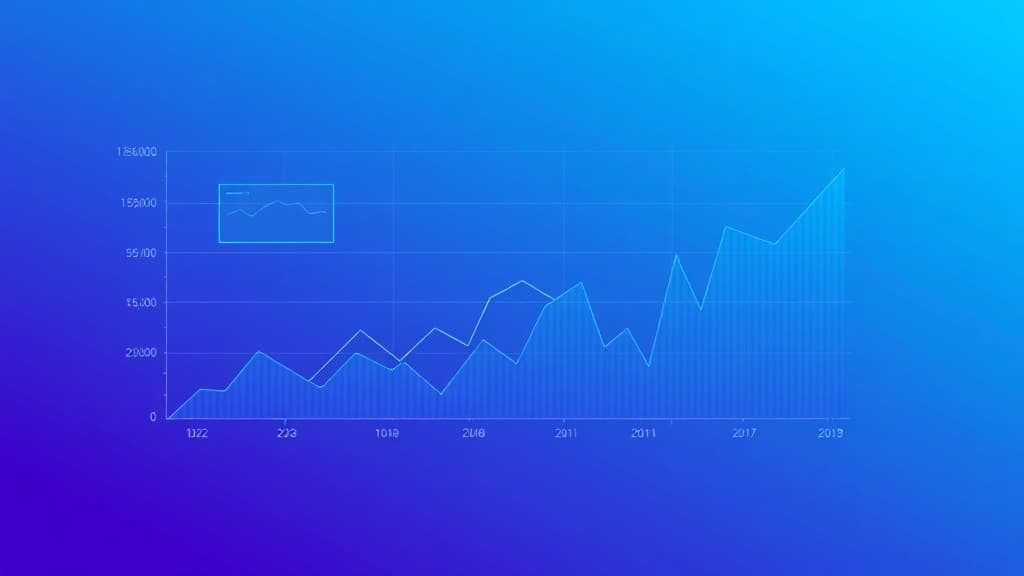

VeChain's journey has been marked by volatility, highlighted by its 93.88% decline from the all-time high of $0.281 back in April 2021. Currently, VET is consolidating around the $0.017 mark, a critical support level. Resistance is seen at the $0.020 psychological level, key for bulls eyeing a recovery.

Technical Indicators

- Relative Strength Index (RSI): Currently neutral, suggesting neither overbought nor oversold conditions. - Moving Averages: VET is below both its 50-day and 200-day moving averages, indicating a bearish trend. - MACD: Showing convergence, hinting at potential price stabilization.Chart Patterns

- Support Level: $0.015 - Resistance Level: $0.020VeChain Fundamentals

VeChain continues to enhance its blockchain platform, focusing on enterprise solutions in logistics and supply chain management. Recent strategic partnerships in sectors like healthcare and sustainability reinforce its commitment to real-world applications. These developments could catalyze adoption and drive long-term value.

Project Highlights

- Enterprise Focus: Logistics, healthcare, and sustainability initiatives. - Dual-Token Economy: VET for value transfer, VTHO for network operations.VET On-Chain Analysis

On-chain metrics remain crucial for understanding VeChain's network health. Metrics like transaction volume and active addresses provide insight into user engagement, which is vital for assessing potential price movements.

Network Metrics

- Transaction Volume: Moderate levels, indicating steady activity. - Active Addresses: Stable, suggesting consistent user engagement.VeChain Scenarios and Price Targets

Bullish Scenario

1. Breaks above $0.020 resistance: Target $0.025 if VET gains upward momentum. 2. Improved market sentiment: Coupled with positive developments, could lead to a sustained rally.Bearish Scenario

1. Fails to hold support at $0.015: Possible retest of lower levels if bearish sentiment prevails. 2. Macro Market Downturn: Could exacerbate VET's decline, testing deeper supports.VET Trading Strategy and Risk Management

Given the current consolidation phase, traders might consider range-bound strategies between the $0.015 support and $0.020 resistance levels. It's crucial to monitor broader market trends as well as VeChain-specific developments to inform entry and exit points.

Risk Management Tips

- Set Stop-Losses: To protect against downside risk. - Position Sizing: Adjust based on volatility and personal risk tolerance.Final Verdict and Key VeChain Takeaways

Here's what I'm seeing in VET: While challenges exist, particularly in reclaiming its previous highs, VeChain's focus on strategic partnerships and enterprise solutions positions it for potential long-term growth. According to the data, breaking above the $0.020 resistance could set the stage for a bullish move, while failing to hold $0.015 support might prompt further declines. For traders, the current consolidation offers both risks and opportunities, with careful monitoring of technical signals and fundamentals being key.

Key Takeaways

- Current Support/Resistance: $0.015/$0.020 - Price Targets: $0.025 in bullish scenarios - Risk Management: Critical in a volatile marketIn conclusion, VeChain's strategic focus and steady network activity provide a foundation for potential recovery. However, the path forward will largely depend on how it navigates market dynamics and enhances its ecosystem in the coming months.

Educational Content Only — Not Financial Advice

This article provides educational information only and does not constitute financial, investment, trading, or legal advice. Cryptocurrency investments carry significant risk, including the potential loss of principal. Always conduct your own research and consult with licensed financial professionals before making investment decisions. Past performance does not guarantee future results. CryptoLumos and its authors assume no liability for financial decisions made based on this content.

Related Articles

Continue exploring more insights

Navigating the Cosmos (ATOM) Market: Key Insights and Strategic Analysis

Cosmos (ATOM) sits at $3.14 with a market cap of $1.49 billion. Despite a 4.62% dip, its strong fundamentals and ongoing developments present growth potential. Key levels are $3.00 support and $3.50 resistance.

Navigating Stellar (XLM) in 2025: Expert-Level Analysis and Price Insights

Stellar (XLM) is priced at $0.310338, with key support at $0.300 and resistance at $0.350. Watch for protocol upgrades and partnerships as potential catalysts.

In-Depth Filecoin (FIL) Analysis: Navigating the Current Market Landscape

Filecoin (FIL) trades at $1.63 with a 2.92% 24-hour change, sitting at #104 by market cap. With strong support at $0.848 and resistance at $2.00, FIL navigates a volatile market, offering potential but necessitating caution.

Image Gallery

Comments

Share your thoughts and join the discussion

Leave a Comment

No comments yet

Be the first to share your thoughts!